It’s the question on many buyers’ minds right now: Should you wait for the Reserve Bank of Australia (RBA) to make more rate cuts, or take action now?

At face value, it might seem smart to wait. After all, lower rates could increase your borrowing power and reduce repayments. But in practice, trying to time the market perfectly can backfire.

Whether you’re looking to upgrade or invest in property in Melbourne, weighing up the risks of waiting versus buying now comes down to your goals, finances and how the market is moving.

The cost of waiting

For buyers looking to upgrade or invest, delaying your move might seem prudent in uncertain times, but it can come at a significant cost:

Missed capital growth

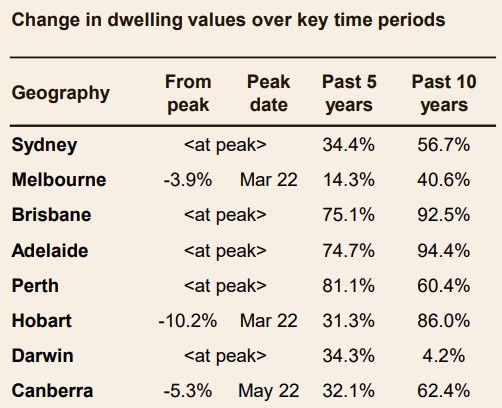

Property values in desirable Melbourne suburbs tend to appreciate over time. Every month spent waiting could mean missing out on potential capital growth. For instance, Melbourne’s median dwelling value declined over the last two years, but since the beginning of 2025 has started to recover. Over the June 2025 quarter, the city’s median dwelling value grew 1.1%, according to Cotality. Over the last 10 years, prices have grown 40.6%.

This recovery suggests buyers waiting for a clear turning point may already be behind it. The long-term growth shows how property continues to deliver value. Short-term rate fluctuations tend to have less impact over time than buyers expect. What matters more is getting into the market early enough to benefit from compounding capital growth.

Increased competition

In the week ending 20 July, only 586 homes were scheduled for auction in Melbourne, according to PropTrack – 9% fewer than the same week in 2024. This subdued activity is partly due to the RBA’s decision to hold rates steady in July, prompting some sellers to delay listing their homes.

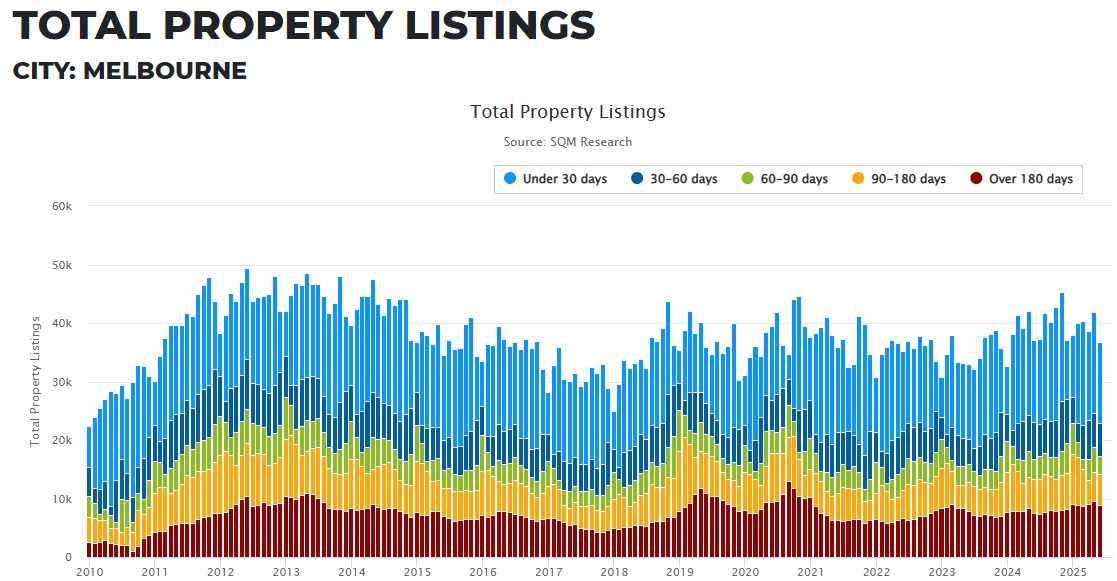

But even before that, stock levels had been lagging. SQM Research also reports that total listings in Melbourne were down 0.8% year-on-year in June.

At the same time, buyer demand is picking up. The Westpac-Melbourne Institute’s July 2025 consumer sentiment bulletin shows rate expectations are at their lowest point in 13 years, and the ‘time to buy a dwelling’ index has risen 16.9% compared to a year ago.

With fewer properties on the market and more buyers regaining confidence, the balance between supply and demand is tipping. If this trend continues, it could lead to tighter competition, faster selling conditions and further price pressure.

Reduced purchasing power

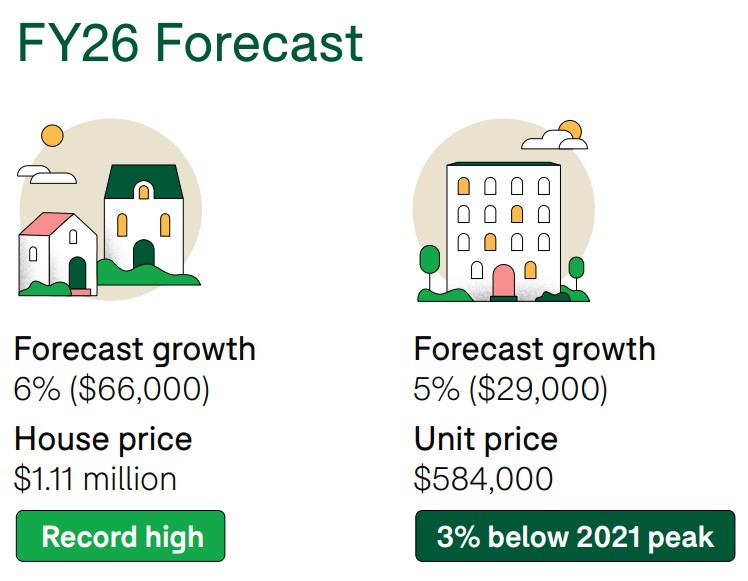

Even small increases in property prices can have a significant impact on what you can afford. Domain is predicting Melbourne’s prices will climb 6% for houses and 5% for units over the 2025-26 financial year. If you are looking at a median-valued house, that’s $66,000 added to the asking price over the next year.

As prices rise, your borrowing capacity may not stretch as far, meaning you could be priced out of your preferred location or need to compromise on property features.

The risks of buying too quickly

While the costs of waiting can be significant, it’s also true that rushing into a purchase without due diligence carries its own set of risks:

Overpaying

Buying quickly without thorough market research can lead to paying more than necessary. A rushed decision might mean missing a better deal if the market shifts.

Emotional bidding, particularly at auctions, can also lead to paying more than a property’s true market value, which can reduce your potential gains.

Overlooking hidden issues

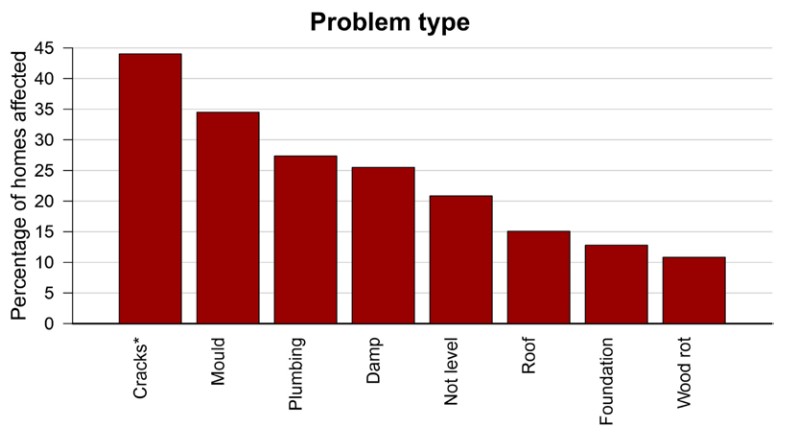

Skipping proper due diligence, such as thorough building inspections, can expose you to costly repairs or legal complications down the road. According to research done by the Australian Housing and Urban Research Institute in 2024, 70% of homes had some building quality problems. Cracks in the walls were the most common issue (44%), followed by mould (35%) and plumbing issues (27%).

Rushing the process increases the chance of missing these critical problems, which can affect both your finances and peace of mind.

Getting thorough pest, building and structural inspections before committing is essential. These reports help you uncover hidden issues early, so you avoid costly surprises later and can negotiate confidently.

Compromising your strategy

Purchasing a property that doesn’t align with your long-term goals can set you back financially and emotionally. Whether it’s location, property type or loan structure, buying without a clear strategy may result in costly compromises, such as higher ongoing costs or difficulties when you decide to sell or rent out the property.

You can’t time the market, but you can be ready

With prices recovering and competition rising, waiting could mean missing out. But market conditions can change anytime, and no one can pick the perfect time. Being financially ready, strategically prepared and confident enough to act when the right property comes up is what matters.

Instead of trying to predict the market, focus on what you can control:

Define your property strategy

Decide what you are looking to achieve with this purchase. Is it an upgrade on your current family home? Or are you buying an investment property to build long-term wealth?

Knowing your goals will help narrow your search and prevent decision fatigue. It also helps you weigh up trade-offs with greater clarity, so you’re not distracted by properties that don’t serve your purpose.

Know your borrowing power

Understanding what you can afford today is key. Lenders’ policies, interest rates and your financial circumstances all play a role in determining your borrowing capacity. Assessing your borrowing power involves a comprehensive look at your income, expenses, existing debts and desired loan structure.

Getting this clarity upfront means you can move quickly and decisively when the right property comes along, without the last-minute scramble of understanding your limits.

Get expert guidance

Surrounding yourself with the right experts can make the process smoother, faster and ultimately more rewarding. A mortgage broker can help you identify your borrowing power, compare suitable products from dozens of lenders and find a loan structure that suits your goals.

Still wondering whether to wait or buy now?

A good mortgage broker in Melbourne, like AXTON Finance, will help you answer the bigger question: is now the right time for you to buy?

We’ll guide you through weighing the pros and cons of buying now versus waiting, based on your unique financial position and property goals. We prepare you for a confident next step – whether that means acting quickly or holding back for the right opportunity.

If you’re unsure whether to wait or buy, talk to AXTON Finance today. Call 03 9939 7576, email [email protected] or click here to get started.