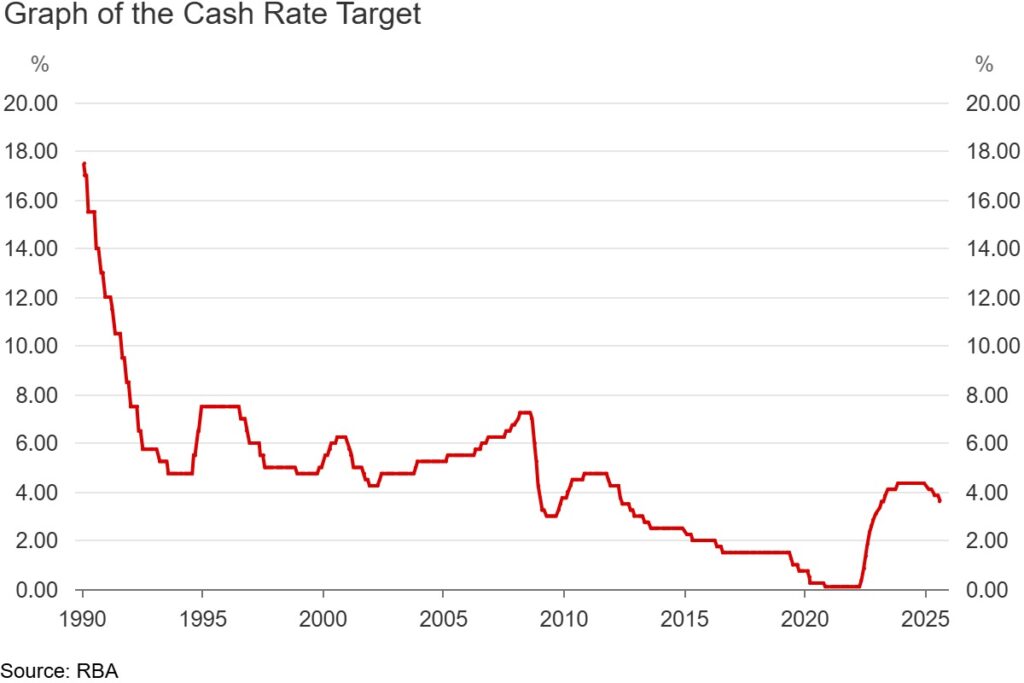

The Reserve Bank of Australia (RBA) has cut interest rates three times in 2025, with more cuts likely. With that, Melbourne property buyers face a critical decision: lock in today’s rates with a fixed loan, or ride the waves with a variable option?

The choice between a fixed vs variable home loan in Australia is one of the most important factors in your financial success. But making the right decision means understanding how each loan type fits your financial goals, risk tolerance and life stage.

Understanding Fixed vs Variable Home Loans in Australia

A fixed-rate home loan locks your interest rate for a set period, typically one to five years. Your repayments remain the same throughout this term, regardless of broader market movements. For example, if you’re paying $4,000 monthly on a fixed loan, that figure would stay constant whether rates rise or fall for the term the loan is fixed.

Variable-rate loans move with market conditions and lender policies. As rates change, so do your repayments. In the same $4,000 example, your monthly commitment could fall if rates drop, or climb if rates rise. How much it increases or decreases will depend on how much interest rates change.

The repayment predictability of fixed loans makes budgeting straightforward. This can be helpful when you’re managing school fees, investment property expenses and career demands. On the other hand, variable loans offer potential savings but require financial flexibility to handle payment fluctuations.

Benefits of a Fixed-Rate Loan

For many of our Melbourne clients, a fixed-rate loan could be a good option. Here’s why:

- Repayment certainty: Your repayments are locked in for the fixed-rate period. This makes it easy to budget for major expenses as you know exactly what your mortgage commitment will be.

- Protection from rate hikes: In a rising interest rate environment, a fixed rate protects you from increased costs. You can rest easy knowing that while others are seeing their repayments climb, yours will remain stable.

- Financial stability: If you value stability over all else, a fixed rate gives you peace of mind. You don’t have to watch every RBA announcement or worry about market shifts affecting your bottom line.

The big drawback of fixed rates is that you could end up paying more than you need to if interest rates drop. Additionally, they often come with limitations. Fixed loans typically carry break costs if you want to exit early, and extra repayment options are often limited or restricted during the fixed period.

Benefits of a Variable-Rate Loan

For those who value flexibility and are comfortable with a degree of market risk, a variable-rate loan can be a good option when looking for the best home loan rates.

- Flexibility and features: Variable loans are known for their flexibility. You can usually make unlimited extra repayments without penalty, which is a significant advantage if you’re looking to pay off your loan faster. They also often offer additional features like redraw facilities and offset accounts, which can help you reduce the interest you pay.

- Potential for savings. With the RBA easing rates in 2025, there is a clear benefit to a variable loan. If rates continue to fall, your repayments will automatically decrease, saving you money in the long run.

- No break costs: If your circumstances change – for example, you get a new job, receive a bonus, or need to sell your property – it can be easier and cheaper to refinance or exit a variable loan compared to a fixed-rate loan.

However, the main risk is that if interest rates rise, your repayments will increase, putting pressure on your household budget.

Choosing a loan for Melbourne’s current market trends

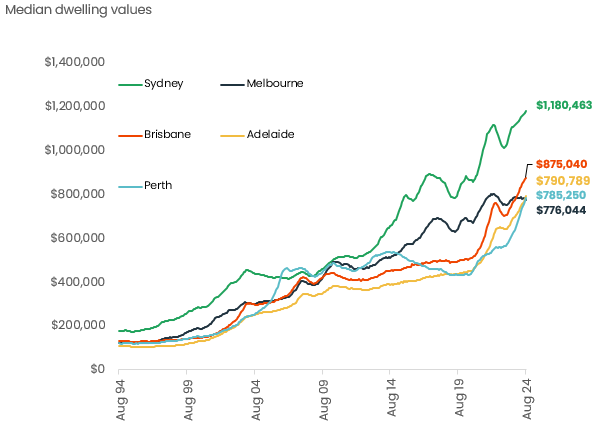

Historically, Australian borrowers have typically favoured variable-rate loans, with fixed-rate lending making up a smaller share of the market. That changed during the pandemic, when record-low interest rates and economic uncertainty saw more borrowers lock in fixed terms. Australian Bureau of Statistics (ABS) lending indicators from 2019–2024 reflect this trend, showing a clear, if temporary, shift towards fixed rates during that period.

But as the RBA began raising rates in early 2022, the trend quickly reversed. Lenders had already started increasing fixed rates in anticipation of the tightening cycle, making variable loans comparatively more attractive again.

That’s because fixed-rate pricing is forward-looking. Lenders base it on where they expect the RBA to move, rather than the current cash rate. If they anticipate a cut, they may lower fixed rates ahead of time to stay competitive and attract new business.

That’s what happened in early August 2025, when several lenders trimmed fixed rates ahead of the RBA’s third cut for the year. A similar trend was seen in May, just before the second cut. These early moves can prompt a short-term lift in fixed-rate demand, especially from borrowers who want to lock in a rate before the next shift.

So far in 2025, the RBA has made three rate cuts, bringing the cash rate to 3.60%.

The most recent data from the ABS shows that annual trimmed mean inflation (which is the RBA’s preferred measure) rose 2.7% in July 2025, a significant jump from 2.1% in June.

That surprise increase has cast doubt over another cut in September. Even so, most major banks still expect a further reduction in November – which could shape borrower decisions between fixed or variable mortgage in 2025.

Who suits each loan type?

The most suitable loan for you depends on your personal circumstances, not just market trends. A fixed-rate loan is often the ideal choice if you prioritise stability and predictability. It’s particularly suitable for budget-conscious buyers who want to lock in their repayments for a set period, providing peace of mind against potential rate hikes.

In contrast, a variable-rate loan may be better suited to those with a higher tolerance for risk and a need for flexibility. If you’re confident you can manage repayment fluctuations and want the freedom to make extra payments without penalty, a variable loan is a strong option. It also positions you to benefit directly from any further rate cuts..

There is a third option. Split home loans divide your borrowing between fixed and variable portions. This provides partial rate protection while maintaining flexibility for extra repayments and offset facilities. Split home loans suit risk-conscious borrowers who want some certainty without sacrificing all flexibility.

Tools like AXTON Finance’s Next Purchase software can help illustrate how each loan type affects your personal situation – not just in terms of monthly repayments, but also overall cash flow, deposit requirements and portfolio exposure. This kind of modelling is particularly helpful when comparing fixed, variable and split options in the context of a broader property strategy.

How AXTON Finance can help

With dozens of lenders offering hundreds of loan variants, comparing options becomes overwhelming. Interest rates are just one factor to keep track of – fees, features, serviceability and lender policies significantly impact your borrowing experience.

At AXTON Finance, we take a holistic view of your finances to recommend loan structures that align with your goals. As part of this process, we use specialised software to model different borrowing scenarios – including how changes in purchase price, loan type, interest rates or sale proceeds could affect your cash flow, deposit and overall loan position. Whether you’re upgrading, investing or refinancing, we help you make fully informed decisions based on real numbers, not guesswork.

Ready to find the right loan for your next property move? Contact Axton Finance today for a no-obligation consultation. Call 03 9939 7576, email [email protected] or get in touch to get started.