From 1 October 2025, major changes to the federal government’s Home Guarantee Scheme (HGS) will make it easier for first home buyers in Melbourne to enter the property market with a smaller deposit.

What’s changing in the Home Guarantee Scheme?

Several key changes are set to benefit Melbourne buyers:

First, the cap on participant numbers has been lifted. That means any eligible first home buyer with at least a 5% deposit can now apply, potentially avoiding lenders mortgage insurance (LMI), which is typically required for low-deposit loans.

Second, income limits have been scrapped. Previously, single applicants earning over $125,000 and couples earning over $200,000 were excluded. Now, higher-income earners and dual-income households can apply, opening the scheme to more professionals who were previously ineligible.

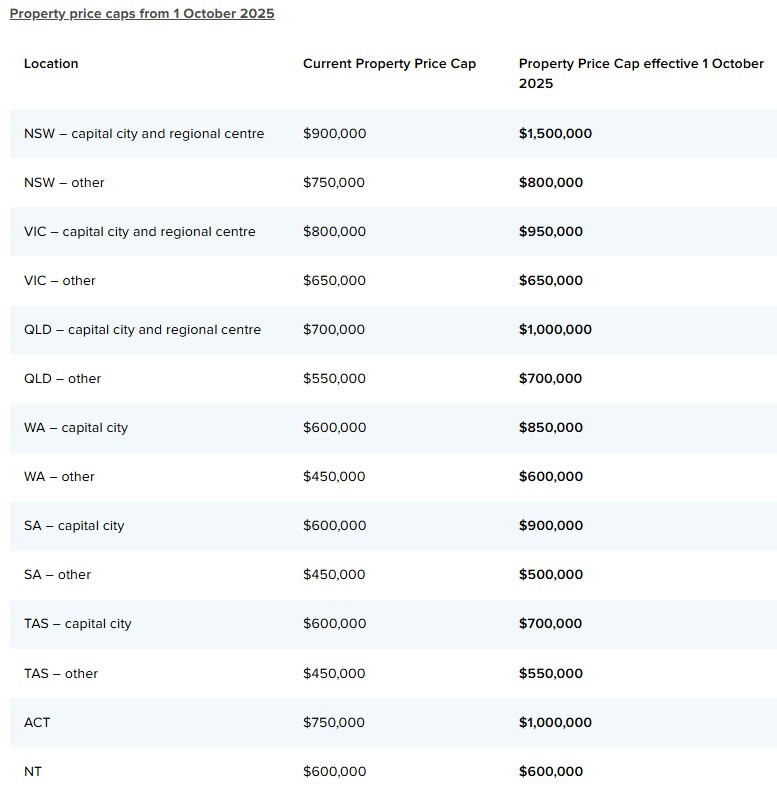

Third, the property price caps have been increased to better reflect current dwelling values. The table below shows the new prices.

In Victoria, the cap for Melbourne and regional centres rises from $800,000 to $950,000.

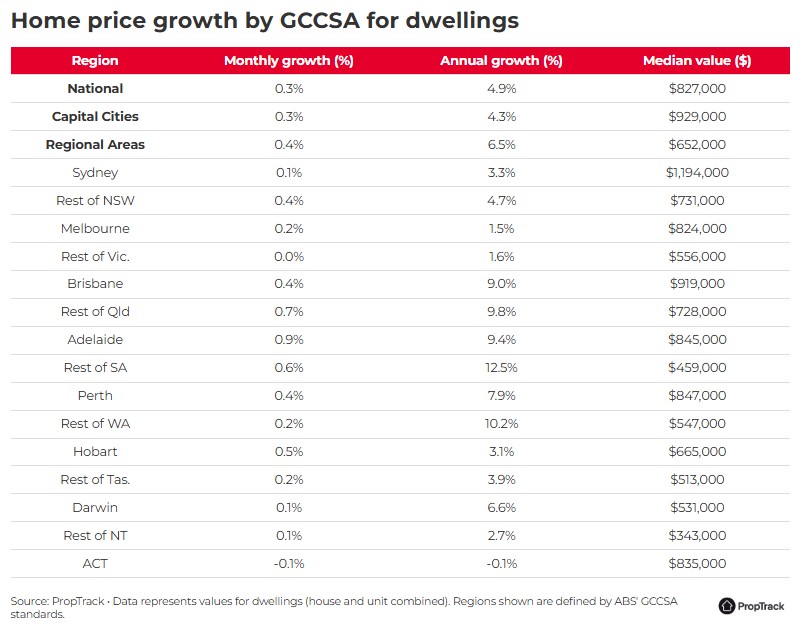

As of July 2025, Melbourne’s median dwelling value was $824,000 according to PropTrack, so the new cap brings more homes and suburbs within reach.

Finally, the Regional First Home Buyer Guarantee will merge into the standard First Home Guarantee, streamlining applications outside capital cities.

How the scheme works

The HGS allows eligible first home buyers to secure a property with a deposit as low as 5%. The government guarantees a portion of your loan (up to 15% depending on the product), meaning you can avoid paying LMI.

Buyers can access loans with the HGS from a selection of more than 30 participating lenders, including major banks, regional banks and customer-owned lenders.

Along with the changes outlined above, the federal government has asked Housing Australia to review the lender panel with the goal of adding more options. This would give buyers a broader choice of loan products and terms to suit their needs.

Applying for the 5% deposit scheme

The application process is straightforward when you work with a mortgage broker:

- Your broker will explain how the Home Guarantee Scheme works and assess your eligibility based on the latest criteria

- They’ll confirm the property price cap for your location and help you understand what kind of property you can target

- They’ll recommend suitable lenders that participate in the scheme and guide you through gathering the right documentation

- They’ll submit your application to the chosen lender for pre-approval and support you through to settlement

- They can also structure your loan strategically to suit your broader financial goals

Why acting fast could pay off

While the changes open the door to more buyers, they could also drive up competition – and prices – in certain brackets.

Experts have warned that the higher caps and wider eligibility may boost demand, especially for homes priced near the $950,000 mark. In Melbourne, that could lead to increased competition for properties around that level, so acting quickly once you’re ready could give you an edge.

Knowing what you’re looking for, getting pre-approval and understanding your budget are critical.

What to plan for beyond the deposit

While the Scheme reduces the barrier of a large deposit, there are other important costs to factor in:

Loan repayments

A smaller deposit means a bigger loan. Ensure your budget can comfortably cover repayments alongside your day-to-day living expenses.

Interest rate fluctuations

Rates can rise over time, affecting your monthly repayments. It’s important to factor potential increases into your financial planning.

Stamp duty costs

Some buyers may qualify for concessions or exemptions, but it’s still a major upfront cost. Your broker can check what you’re eligible for.

Legal and conveyancing fees

You’ll need to budget for the cost of a solicitor or conveyancer to manage the legal side of your purchase.

Property maintenance costs

Owning a home comes with ongoing costs such as repairs, insurance and utilities. These should be included in your budget.

Long-term financial planning

Consider how your mortgage fits with broader goals, like saving for retirement, investing or family planning.

Modelling your finances with AXTON’s Next Purchase software

To help you plan with confidence, AXTON Finance offers the Next Purchase software. This tool lets you model cash flow, stamp duty, ongoing costs and borrowing capacity both before and after settlement.

By testing different scenarios, including changes in interest rates, deposit size or purchase price, you can see how each decision impacts your long-term position.

Combined with expert advice from a mortgage broker, this tool helps you buy with clarity and confidence.

Why working with a broker can help

A mortgage broker can guide you through the updated Home Guarantee Scheme rules, help you access the right lender and structure your application for maximum benefit. With unlimited places, higher caps and increased eligibility, demand is expected to spike. Having an expert guide the process gives you a stronger chance of securing the right loan and the right property.

At AXTON Finance, we specialise in helping first home buyers navigate these opportunities, matching you with the right lender and ensuring your loan supports your long-term financial goals.

Thinking about buying with just a 5% deposit? With new price caps and unlimited places, now’s the time to act. AXTON Finance can guide you through the scheme and help you secure the right loan. Call 03 9939 7576, email [email protected] or get in touch to get started.