How Does Refinancing Your Home Loan Save You Money?

When Australian academics researched the difference between renting for life and investing your hard-earned income into property ownership, the results were clear. Taking the leap into buying your own property gives you a better return in all Australia’s capital cities. The University of Melbourne economists came to their conclusion after studying data from 1983 – 2015 and compared buying a house with renting and investing in a combination of term deposits and shares.

But as house prices increase around the country, shopping around for the best possible home loan deal with a low interest rate is more important than ever.

If you’re already lucky enough to be a property owner, refinancing your existing loan in order to get access to a better deal could be a smart move for your mortgage.

Choosing A Home Loan For Refinancing

The days of signing up for a mortgage with a 30-year repayment term are gone as banks and other lenders scramble to offer great deals that help them win customers. But as today’s workforce habits continue to evolve, flexibility is an important thing for borrowers to enjoy, and it’s important to remember that the best mortgage for you might be about more than just a low interest rate. To help you benefit from refinancing your existing home loan, take a closer look at extras on offer, and weigh up the benefits those extras may offer, in combination with the all-important interest rate.

The three main types of home loans include:

Basic loans: these no-frills frills loans typically have limited added features and a low interest rate. Although many now offer redraw facilities, there can be restrictions and fees, so if you want to make extra repayments at some point in the life of your loan this may not be the best deal for you.

Standard loans: you’ll enjoy greater flexibility that may include the ability to redraw money you have paid in, or the option to switch to a fixed rate, or perhaps split your home loan into both a fixed rate and variable rate home loan. You can also enjoy a 100% offset account but it’s important to shop around to find a loan with a cheaper interest rate and similar features.

Home loan package: this can include a standard loan with an interest rate discount that, depending on your loan amount, might be cheaper than many basic loans. The package can include a free transaction account and a credit card with no annual fee. But be warned of other hidden costs, including high package fees that can add up over the life of your mortgage.

Variable or fixed?

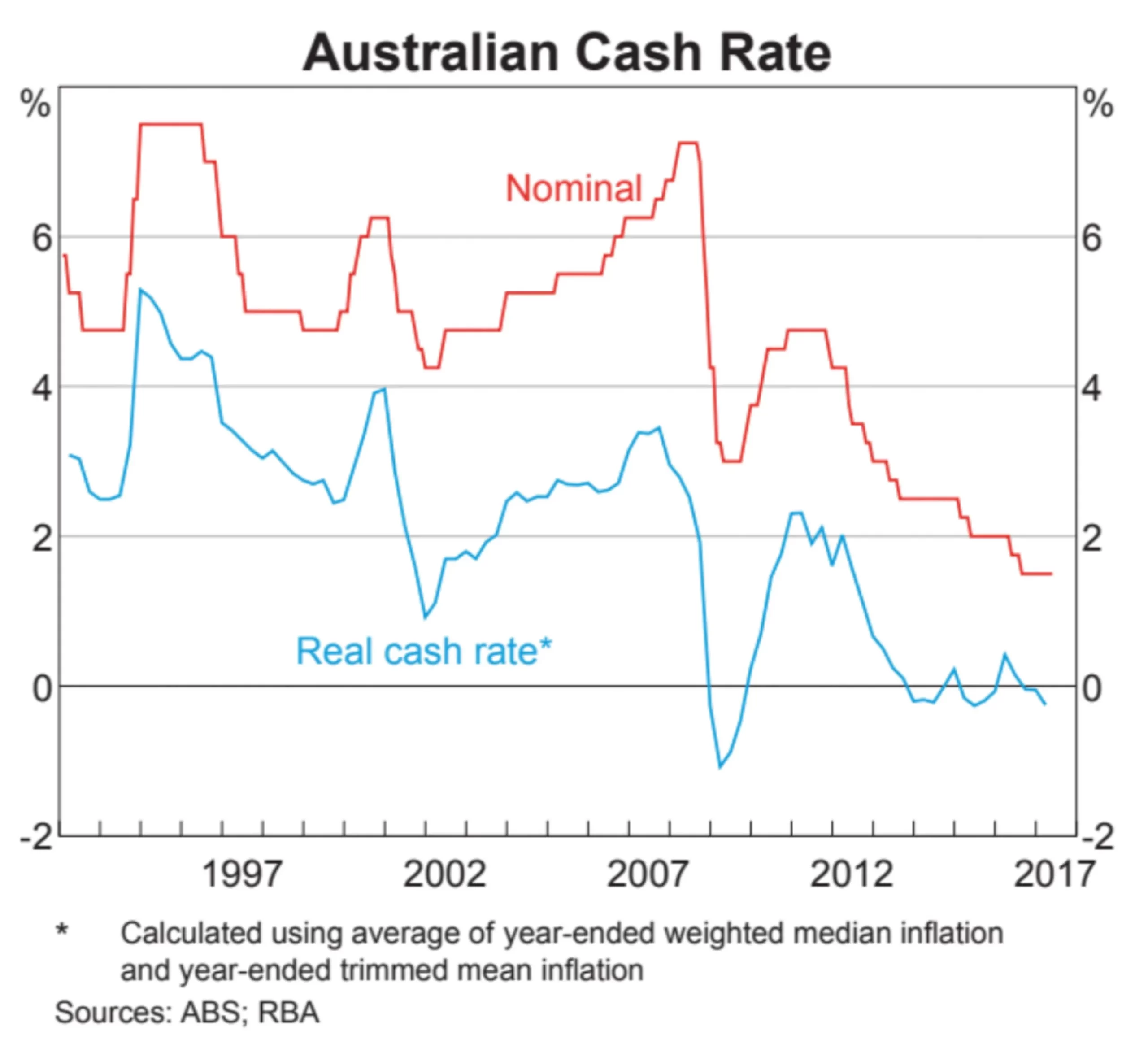

In these times of hefty house prices, low fixed rates can sound tempting.

Keep an eye out for reduced flexibility, including restrictions that may prevent you from making extra payments – something that can see your total interest soar over the life of your mortgage.

With rates always fluctuating, it’s difficult to predict if choosing a fixed rate over the next three or five years will save you money in the long-term. By asking yourself if you can afford a higher interest rate, you can make a well-informed decision about whether fixing the rate for at least part of your loan might be a good option.

A split loan can offer the best of both worlds and it’s something you’ll understand better by talking to an experienced mortgage broker.

Don’t Forget The Loan Fees

To help you choose the best refinancing deal for your mortgage, remember that interest rates are just one of the costs to think about. Always check the ongoing fees and charges that add up over the life of your home loan.

Asking for a better deal might just be the best thing you can do for your mortgage but it’s best to go into any refinancing deal with your eyes wide open.

Some common fees include:

Application fees

Valuation fees and lender’s legal fees

Lender’s mortgage insurance (LMI)

Monthly or annual fees

Break costs

Favourite Home Loan Features

Depending on your personal circumstances, there might be some home loan features you’ll love. These include:

- Extra repayments – make accelerated repayments to pay off your home loan sooner

- Redraw facility (some redraw facilities are easier to access than others, so talk to your broker to understand what’s on offer before committing)

- Repayment holidays (with some mortgages allowing you to take a ‘repayment holiday’ for a short period to help you through lifestyle stages – such as having a baby – it’s smart to shop around to find one that suits your individual needs)

- Interest only – although this will be more expensive these days (check out our other blog topic here why this is the case)

- Mortgage offset accounts – the balance of your savings account reduces the interest charged on your mortgage and is usually calculated daily.

To help cut through the confusion and find the best deal to refinance your mortgage, talk to our team today or just call us on 1300 706 540 to discuss your scenario.