What is Rentvesting?

Rentvesting is an increasingly popular millennial property investment strategy that allows you to rent in your preferred location while purchasing an investment property in a more affordable area. This approach enables you to enjoy the lifestyle you desire without sacrificing the opportunity to enter the property market and start building wealth. Rentvesting also doesn’t need to be restricted to just your hometown—investment opportunities can be identified in affordable interstate markets and high-performing regional areas, allowing you to maximize capital growth potential across different locations.

Why is Rentvesting Gaining Popularity in Melbourne?

- Melbourne’s expensive property prices make homeownership in prime locations increasingly difficult.

- Rentvesting provides a pathway to property ownership without requiring a massive upfront investment for an owner-occupied home.

- You can benefit from capital growth in high-performing suburbs while maintaining lifestyle flexibility.

Why You Should Consider Rentvesting Over Traditional Homeownership

Overcoming the Affordability Challenge

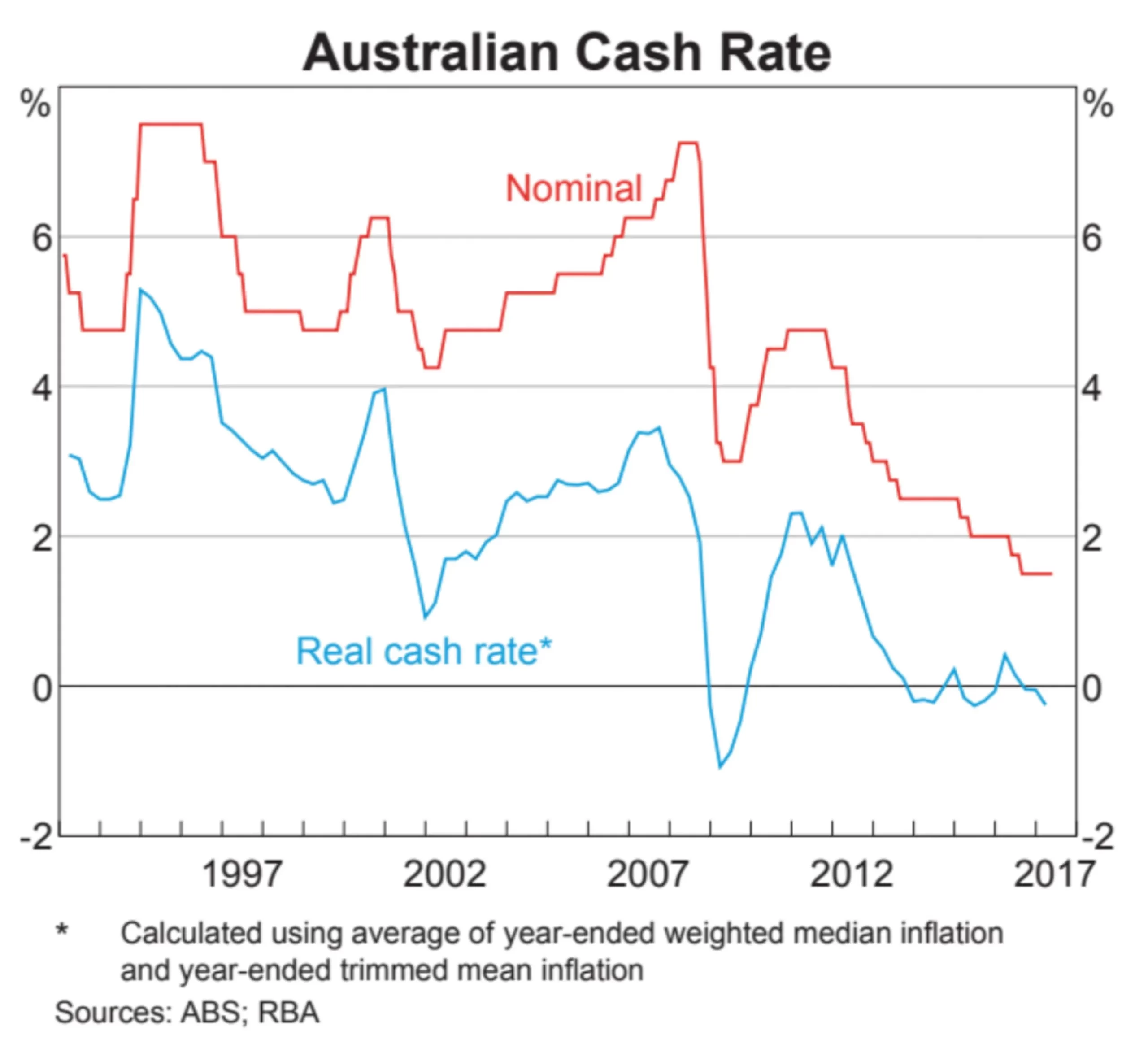

- The median house price in Melbourne has surged over the past ten years and, despite stabilizing in the last 18 months (at the time of publishing), may accelerate again as interest rates decrease. This can make it challenging for first-time buyers to purchase in their ideal locations.

- Rentvesting allows you to enter the property market sooner without overstretching your finances, giving you more control over your investment journey.

Enjoy Lifestyle Flexibility While Investing

- If you prioritize experiences, travel, and vibrant city living, rentvesting allows you to continue enjoying these without being tied to an excessive mortgage in an expensive area.

- You can live in desirable areas while securing an investment property elsewhere that fits within your financial strategy.

Build Long-Term Wealth Through Property

- Instead of waiting years to save for a home in your dream location, as prices accelerate away from you, rentvesting enables you to start building equity sooner.

- A well-located investment property generates rental income, capital growth, and potential tax benefits, all contributing to your financial security.

The Benefits of Rentvesting

- Enter the Market More Affordably

- You can step into the property market with a smaller deposit and lower initial costs.

- Buying in growth areas provides a stronger potential for long-term capital appreciation.

- Take Advantage of Tax Benefits

- Claim deductions on mortgage interest, property management fees, and depreciation (seek taxation advice for details).

- Reduce taxable income through negative gearing benefits (taxation advice required).

- Create Wealth Sooner

- Rentvesting can help you build a diverse property portfolio over time.

- Use rental income to help pay down the mortgage on your investment property.

- Enjoy Greater Flexibility

- Continue renting in your preferred location without being locked into a large mortgage on your primary residence.

- Adapt easily to career changes, travel, or lifestyle shifts without the burden of selling a home.

Rentvesting Strategies for Success

Choosing the Right Investment Property

- Research high-growth suburbs in Melbourne with strong rental demand and capital appreciation potential.

- Select properties with a steady rental yield to ensure a positive cash flow investment.

Balancing Your Lifestyle and Smart Investment Choices

- Set clear financial goals to align rentvesting with long-term wealth creation.

- Avoid overcommitting by ensuring mortgage repayments remain manageable—just because a lender says you can borrow a certain amount doesn’t mean it’s the right decision for you.

Securing the Right Outcome

Having the right experts in your corner is essential to turning your rentvesting plans into a reality. By working with experienced professionals, you can make informed decisions that maximise your financial success while minimising potential hurdles.

- Mortgage Broker: An experienced mortgage broker in Melbourne or Sydney will help you navigate the best loan structures tailored to rentvesting. There are multiple pathways to securing a loan with a deposit that may be lower than you think. This can include industry-specific lending policies for doctors, lawyers, engineers, and essential workers, access to government incentives, hybrid lending products that boost your borrowing capacity, or lenders mortgage insurance (LMI) options that enhance your purchasing power. Speak to the experienced team at Axton Finance today to discover what your options are.

- Buyer’s Advocate: Engaging a flat-fee buyer’s advocate can provide invaluable insights into identifying and securing high-quality investment opportunities. AXTON Finance now offers this as an optional in-house service to help you accelerate your investment plans and negotiate with a plan that helps you win.

- Property Manager: A great property manager is crucial to ensuring your investment is well-maintained and your tenants are reliable. They handle the day-to-day responsibilities, including rent collection, maintenance coordination, and compliance with tenancy laws. A skilled property manager will also help you navigate the ever-evolving rental regulations, ensuring you avoid problematic tenants and maintain a stress-free investment.

- Conveyancer or Solicitor: A legal expert will guide you through the contractual and settlement processes, ensuring a smooth and compliant transaction. Our preferred contacts can even help you review a shortlisted contract before you negotiate – as the saying goes – it’s not what’s in a contract – it’s what isn’t that matters!

- Pre-Purchase Inspections: Conducting thorough building and pest inspections will help you avoid unexpected surprises, dodgy DIY repairs, and hidden issues that can help protect your investment.

How AXTON Finance Can Help

At AXTON Finance, we specialize in helping first-time investors navigate the rentvesting strategy with expert real-world mortgage advice. Our team ensures you secure the right loan structure and helps you build wealth through smart property investments.

Ready to start your rentvesting journey? Contact AXTON Finance today for an obligation-free discovery discussion on how we can help you achieve your property goals!